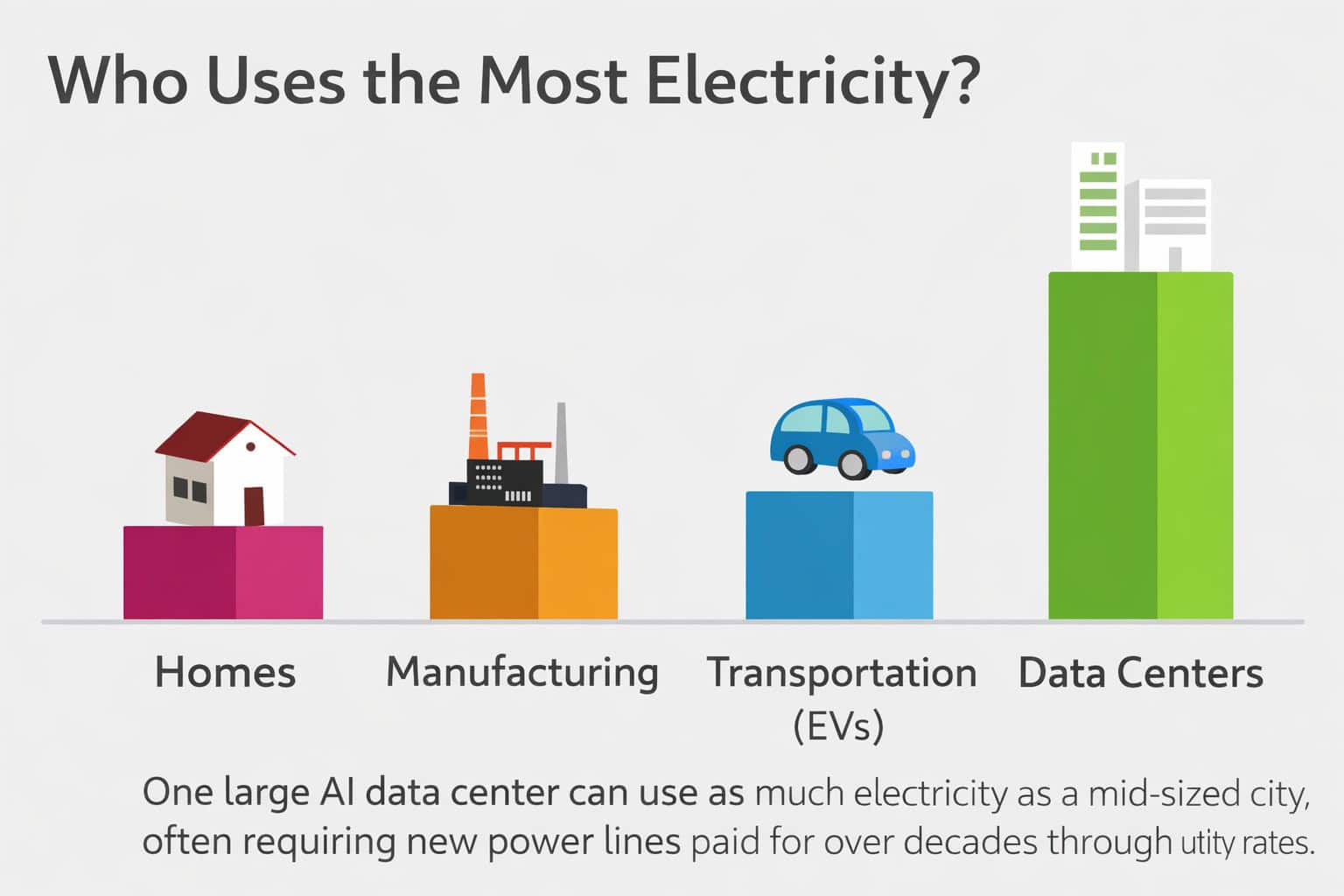

DETROIT – Thanks to Gov. Whitmer’s new road-funding plan, electric vehicle registration will cost an additional $100 annually, or an 83 percent increase, bringing the fee to $260 before accounting for the standard vehicle registration cost. Combined, this could cost some owners more than $400.

The change moves Michigan from the middle of the pack up to a two-way tie for the nation’s highest EV taxes, according to the Michigan Energy Innovation Business Council (MEIBC).

“One casualty of the rushed road funding deal is fairness in how Michigan treats its drivers,” said Sophia Schuster, policy principal for MEIBC. She called it a likely unintended consequence.

“By raising EV fees to the highest in the country, the state is discouraging adoption and signaling to automakers that Michigan is not serious about leading in transportation electrification.”

Earlier this month, Gov. Gretchen Whitmer and the legislature agreed to remove sales tax from fuel and apply a matching increase to the fuel tax. That means drivers will pay the same amount of taxes at the pump, but more of that revenue will go to the transportation fund.

However, state law requires an increase of $5 to the EV registration fee, and an increase of $2.50 to a hybrid vehicle registration, per 1 cent raise of the state’s gas tax. So while drivers of gas-powered vehicles will pay the same amount after the tax change, EV and hybrid drivers will pay more.

Schuster said EV drivers on average were already paying about $20 more per year into roads than their peers who drive gas-powered vehicles. She noted studies that say otherwise tend not to compare apples to apples.

“When you take dollars spent per gallon, the entire gas tax and wholesale tax, yes, internal combustion engine drivers were technically paying more wholistically,” Schuster said. “However, when you break it down into what’s being contributed to roads from those dollars, they’re not.”

Last month, Sen. Sam Singh, D-East Lansing, proposed changing state law to reduce EV and hybrid registration fee increases tied to the fuel tax.

Under Senate Bill 593, a plug-in hybrid vehicle’s annual fee would increase 94 cents for every cent the fuel tax increased above 19 cents per gallon. For EV, the increase would be $1.88 per 1 cent of fuel tax.

Read more at MLive